Client Testimonial

Managing a crypto-exchange platform is always a big challenge – but we made it simple with AI-driven liquidity management system.

Andrew Parker, Product Head

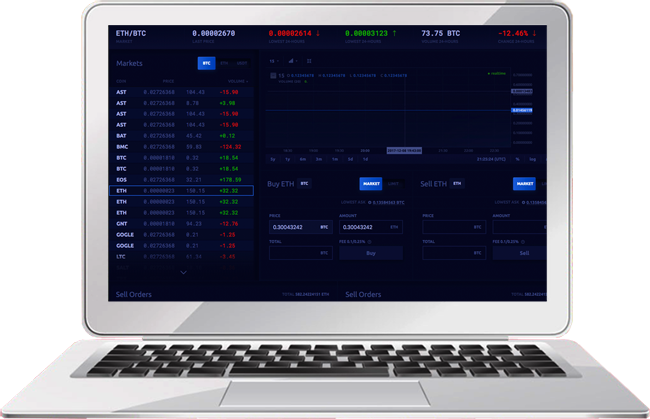

Crypto-Exchange with AI-driven Liquidity Management system

With the aid of a unique AI-driven liquidity robot, this Crypto-exchange platform checks more than 100 accounts on external exchanges and can get additional liquidity for complex orders. Based on these technologies, SamEx can offer the best exchange rates to the customers.

Managing a crypto-exchange platform is always a big challenge – but we made it simple with AI-driven liquidity management system.

Andrew Parker, Product Head

There are lots of classic crypto exchange platforms out there, but many of them lack proper liquidity management, i.e., the ability to fulfill all customers’ orders with a good exchange rate.

Security is also a big issue. A lot of crypto-exchanges platforms were hacked in the last two years. So it’s important to provide maximum protection to the service.

SamEx is a subsidiary of SamBanx group focused on crypto-exchange operation with crypto-crypto and

crypto-fiat trading pairs.

Our trading robot is built to track orders booked on 12 major crypto exchanges and get additional liquidity when needed. The robot works with 100+ accounts on 12 trading with real-time full order tracking.

The security of the platform has been tested and trusted by 3rd party companies. We have built a solution using best world practice in SIEM field. The exchange has a network protection, endpoint protection, DDoS protection, and regular vulnerability scans with log management.

Crypto-exchange platform with best exchange rates and liquidity.

AI Driven liquidity management robot.

Secure and reliable solution.